THE #1 SOLUTION

Stop IRS Surprises

Before They Happen

Affordable proactive IRS transcript monitoring that protects you from penalties, stress, and unexpected tax bills before they snowball into financial disasters.

Trusted by Tax Professionals

Secure IRS Authorization

Cancel Anytime

The IRS Doesn't Wait –Why Should You?

Even the most responsible taxpayers get blindsided. Missing forms trigger automatic penalties, and by the time you receive a notice, the damage is already compounding.

Without Knight Monitoring

With Knight Monitoring

Without Knight Monitoring

Day 1 - Missing form filed late

Day 30 - IRS posts penalties to your account

Day 45 - Interest begins accumulating

Day 90+ - IRS notice finally mailed

Result: $215,000+ in penalties

With Knight Monitoring

Day 1 - Missing form filed late

Day 1 - Missing form detected immediately

Day 1 - Missing form detected immediately

Day 30 - IRS posts penalties to your account

Day 1 - You receive instant alert

Day 1 - You receive instant alert

Day 45 - Interest begins accumulating

Day 2 - Issue resolved before penalties

Day 2 - Issue resolved before pentalties

Day 90+ - IRS notice finally mailed

Ongoing - Peace of mind maintained

Ongoing - Peace of mind maintained

Result: $215,000+ in penalties

Result: $37.42 total cost

Result: $37.42 total cost

90+ Days

Before IRS notices arrive

24%

Annual penalty rate

$10K+

Average attorney retainer

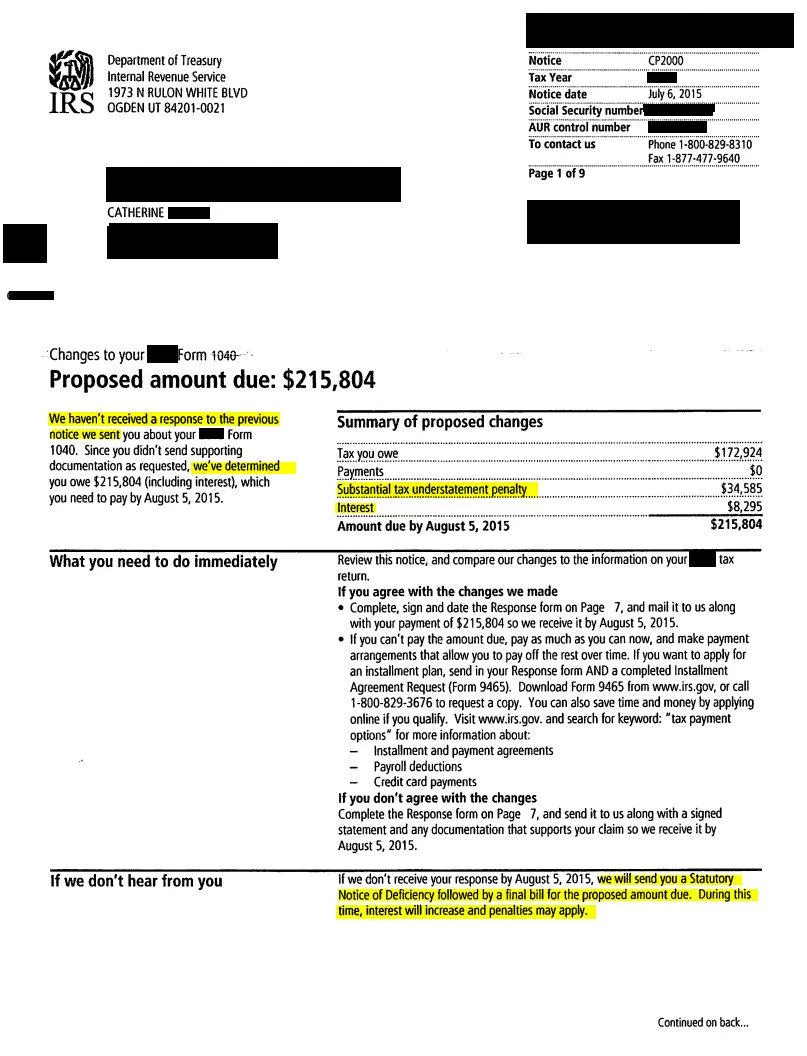

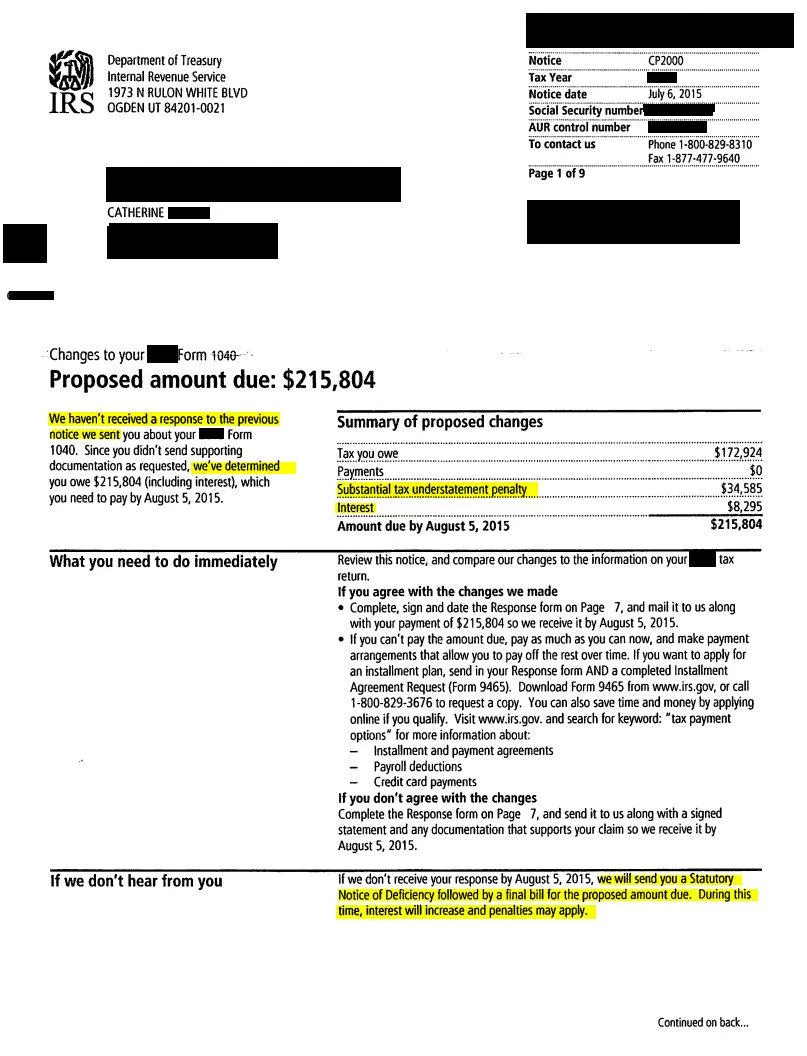

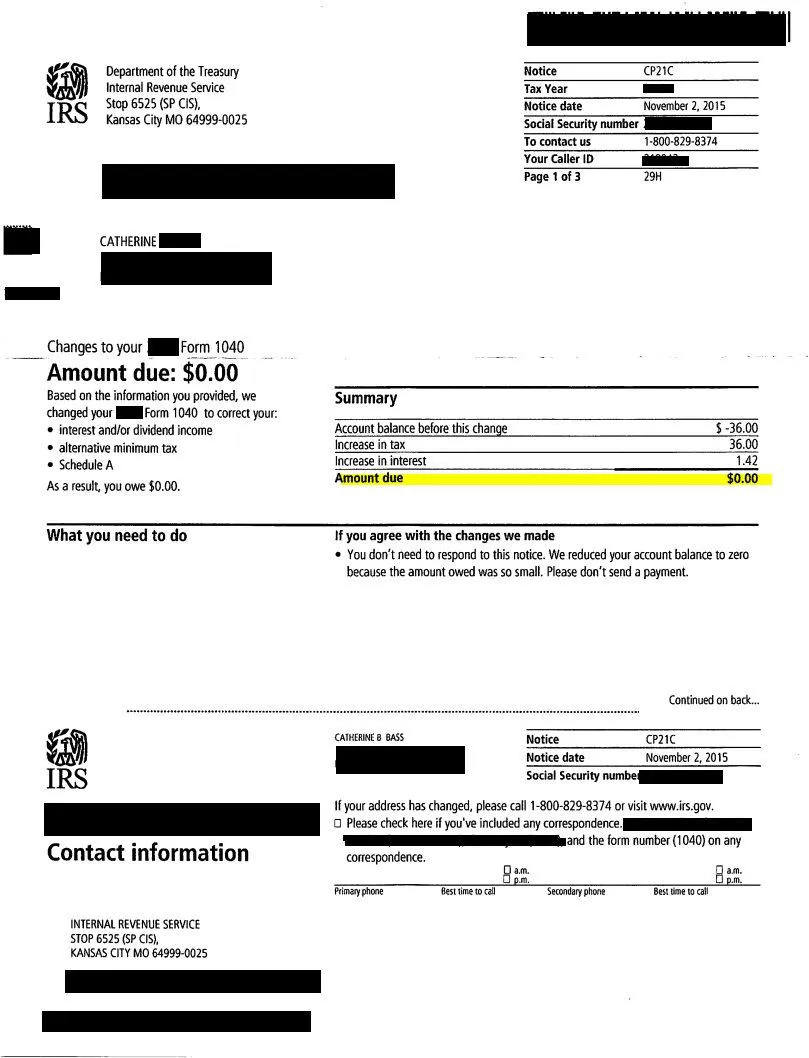

Catherine's $215,000

IRS Nightmare

Catherine always filed her taxes on time and followed every rule. But when a critical tax form filed by a third party never made it to her accountant, the IRS automatically generated a notice claiming she owed $215,000 in taxes and penalties.

The Crisis Unfolds

Despite Catherine's meticulous record-keeping and timely filing, a missing tax form from that third party triggered an automatic IRS assessment. The system showed all of that income unreported, generating massive penalties and interest charges.

Traditional tax resolution could have required a $10,000+ attorney retainer just to begin addressing the problem, with no guarantee of success.

The Knight Solution

Unfortunately, Catherine was not protected by Knight IRS Transcript Monitoring. Our system would have detected the issue immediately, allowing our team to intervene quickly and alert her immediately, allowing us to resolve the matter before penalties and interest could compound.

Your Financial Shield Against

IRS Surprises

Knight IRS Transcript Monitoring provides comprehensive protection that works behind the scenes to keep your finances safe from unexpected penalties and notices.

Early Alert System

Get notified of IRS account changes before notices are mailed, well in advance.

Prevent Penalties

Stop penalties and interest from compounding by catching issues at the source.

Save Time & Stress

Avoid the panic and chaos of unexpected IRS notices with proactive monitoring.

Early Alert System

Get notified of IRS account changes before notices are mailed, well in advance.

Prevent Penalties

Stop penalties and interest from compounding by catching issues at the source.

Save Time & Stress

Avoid the panic and chaos of unexpected IRS notices with proactive monitoring.

Complete Protection

Your financial shield against IRS surprises, operating 24/7 in the background.

Expert Support

Backed by PFL Tax Service professionals who know how to resolve issues quickly.

Secure & Authorized

Fully authorized IRS transcript access with bank-level security protection.

Complete Protection

Your financial shield against IRS surprises, operating 24/7 in the background.

Expert Support

Backed by PFL Tax Service professionals who know how to resolve issues quickly.

Secure & Authorized

Fully authorized IRS transcript access with bank-level security protection.

4.9/5 star reviews

Enroll in Knight IRS Transcript Monitoring Now!

Don't wait for penalties to pile up. Protect yourself today.

Knight Protection:

24/7 IRS transcript monitoring

Instant alerts before notices

Expert resolution support

Prevent penalties & interest

Risk-free with our satisfaction guarantee

Jonathan Ferrell

"The setup was simple. The peace of mind they provide is worth every penny, I wouldn’t trust my taxes to anyone else!"

Testimonials

Have any of you ever had to deal with the IRS? Well, if you have, then you know how frustrating it is and you never get the answers you really need! I recently went through this ordeal with the IRS which left me uncertain, more frustrated, needless to say fearful of what the IRS might do. I DO NOT TRUST THEM! Thanks to Tony & Catherine Bass, they were able to get the answers I needed and get things resolved. I also learned they provide a monitoring service that allows you (the taxpayer) to get notified in the event the IRS is "up to something"! This allows you to get ahead of the game and take care of things and avoid any unpleasant action that the IRS might want to take. This could be garnishments, liens, or even freezing your assets. I am very happy to be enrolled in this affordable service. It's a great value and worth having!

- Dr. Bhagirath Bhatt

STILL GOT QUESTIONS?

Frequently Asked Questions

Our Satisfaction Guarantee

At PFL Tax Service, your peace of mind is our priority. We are so confident in the value of our service that we offer a Satisfaction Guarantee:

No Long-Term Contracts: You’re free to cancel anytime.

$300 Per Tax Payer Setup Fee Waived: We waive our standard setup fee to make it easy for you to get started.

Fair Policy: If you choose to cancel within the first six months, the waived $300 setup fee per tax payer will be applied at the time of cancellation.

Our goal is to ensure you feel confident and supported in your tax preparation. Most clients stay with us year-round because the protection and accuracy we provide are invaluable—especially during tax season.

Do I need this if I always file my taxes on time?

Absolutely! Even if you're perfectly compliant, missing forms from third parties (like employers, banks, or business partners) can trigger IRS penalties. Catherine always filed on time, but a missing tax form resulted in a $215,000 assessment. These issues are often beyond your control, but Knight Monitoring catches them early so they can be resolved quickly and affordably.

How do you monitor my IRS transcripts?

We use secure, IRS-authorized transcript access through proper legal channels. You'll provide us with limited authorization (Form 8821) that allows us to access your transcript information only. This is the same authorization you'd give to any tax professional. All data is encrypted and handled with bank-level security protocols.

What happens if I still receive an IRS Notice?

If you receive a notice, you're already ahead of the game! Knight Monitoring typically detects issues weeks or months before notices are mailed. This early warning allows us to help you resolve matters quickly and affordably, often preventing penalties entirely or minimizing them significantly. Compare this to the shock of an unexpected $215,000 notice!

How quickly will I be notified of issues?

Our monitoring frequency is determined by the level of service you choose. It can range from weekly to monthly, and you'll typically be alerted within 24-48 hours of receipt of transcript updates. This gives you a massive head start compared to waiting 60-90 days for a notice to arrive in the mail, by which time penalties have already started accumulating.

Is my personal information secure?

Your security is our top priority. We use bank-level encryption, secure data centers, and strict access controls. We're fully licensed tax professionals bound by confidentiality requirements. Your information is never shared with third parties and is protected by the same standards that govern all professional tax services.

Can I cancel anytime?

Yes, you can cancel at any time. We do not lock you into long-term contracts. However, please note that we are currently waiving our standard $300 setup fee per taxpayer. If you choose to cancel within the first 12 months, the waived $300 setup fee per taxpayer will be applied at the time of cancellation.

Most clients find the peace of mind and protection so valuable that they maintain coverage year-round, especially during tax season and the months following when IRS assessments are most common.

What if nothing happens to my account?

That's the best-case scenario! The goal of Knight Monitoring is prevention. If nothing happens, it means you're protected and can enjoy peace of mind. Think of it like insurance - you hope you never need it, but you're grateful to have it when you do. Remember, Catherine was 'fine' until she suddenly owed $215,000. Prevention costs far less than crisis management.

How is this different from just checking my own account?

Most taxpayers don't know how to read IRS transcripts or what changes indicate potential problems. Our tax professionals know exactly what to look for and can interpret transcript changes in context. Plus, we monitor continuously while you focus on your life and business. When we spot an issue, we can often resolve it immediately through our professional channels.

STILL NOT SURE?

We Stand Behind Our Work!

Copyrights 2025 | PFL Tax Service | Terms & Conditions